Hydrogen may offer a $2.5 trillion investment opportunity – report identifies companies set to benefit

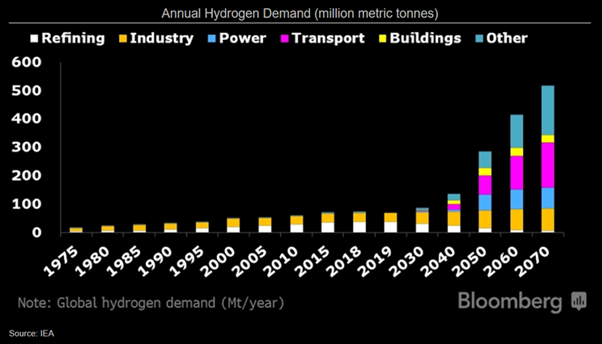

Overall, the hydrogen revolution may provide a $2.5 trillion investment opportunity through to 2050 for utilities, equipment makers and others seeking to curb emission intensity according to a new report from Bloomberg Intelligence (BI). Annual demand-growth potential could reach 5% to 7%, according to Bloomberg NEF, to hit 7% of global energy use by the middle of the decade.

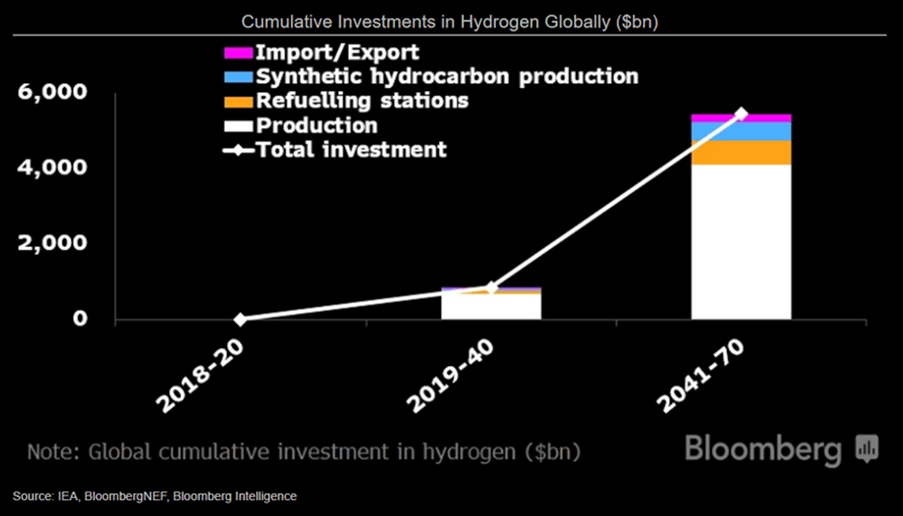

During 2018-20, investments averaged about $1.5bn a year, this is likely to increase to $38bn per annum during 2019-40 and $181bn annually during 2041-70, according to International Energy Agency (IEA) projections.

According to BI, companies across many industries are making early bets on hydrogen in order to gain a competitive edge before the market matures. Among energy, chemical and metallurgic companies, Shell, Orsted, Engie, Neste, Linde and SSAB are making more progress in expanding hydrogen activities than Gazprom.

Within industrials, Alstom has a head start over CAF and Siemens, believes BI. Equipment suppliers, such as Plug Power, ITM Power and Faurecia should also benefit from the hydrogen boom.

Elchin Mammadov, BI senior industry analyst, said, “Hydrogen would be necessary for the world’s largest emitters — the U.S., China and Europe – to achieve net-zero climate targets by 2050-60 by decarbonising hard to abate industries. Investment opportunity abounds, though subsidies are essential for the initial scale-up and to achieve cost reductions, since hydrogen production is very expensive.”

Globally, Europe is leading the way on the number of hydrogen projects thanks to pro-climate policies, including net-zero emissions targets adopted by Governments and companies.

The EU as well as many of its member states, South Korea and Japan have already developed hydrogen strategies, with the UK following later this year. The EU green hydrogen package envisages a cumulative €150bn investment by 2030 to deploy at least 6GW of electrolyser capacity to produce up to one million tons of renewable hydrogen by 2024 and 40GW by 2030 to make up to 10m tons.

Elchin Mammadov added, “Governments will need to develop new policies and regulation and initially offer subsidies such as contracts for difference, high carbon prices or low taxes, faster deployment of low-cost renewable energy to address the chicken-and-egg problem facing hydrogen producers, infrastructure operators and potential consumers.

“To encourage regulated utilities to invest in hydrogen networks, authorities will have to allow grid operators to include hydrogen-related works in their rate base.”

Uncertainty on future carbon prices, Government subsidies, economies of scale and the learning curve means there is a huge variation in forecasts for hydrogen investment and consumption growth.

WoodMac estimates that a cumulative $1 trillion of capital investments will be needed by 2050, while the IEA’s projections imply about $2.5 trillion during that period. Similarly, there is also a wide variation in projections for hydrogen demand in 2050, with Bloomberg more bullish than WoodMac and the IEA.

However, BI believes that hydrogen offers growth opportunities to utilities (Orsted, RWE, Snam), manufacturers (NEL, Plug Power, Alstom), refiners (Neste), transport (Nikola), metals and mining (Anglo American, ThyssenKrupp) and other companies seeking to curb emission intensity (Linde, Equinor).

End.

Green Infrastructure Week curates’ content from the entire ecosystem around green infrastructure from government and NGOs to respected commentators.

Feel free to share this content with your social media community using #GreenInfrastructureWeek

During Green Infrastructure Week we will host a programme of live and exclusive free-to-attend webinars.